Bookkeeping is not everyone’s cup of tea… or their glass of wine. I get that and that’s why I do what I do. My focus is around getting my client’s back to doing what they do best and WHY they got into business in the first place… their PASSION.

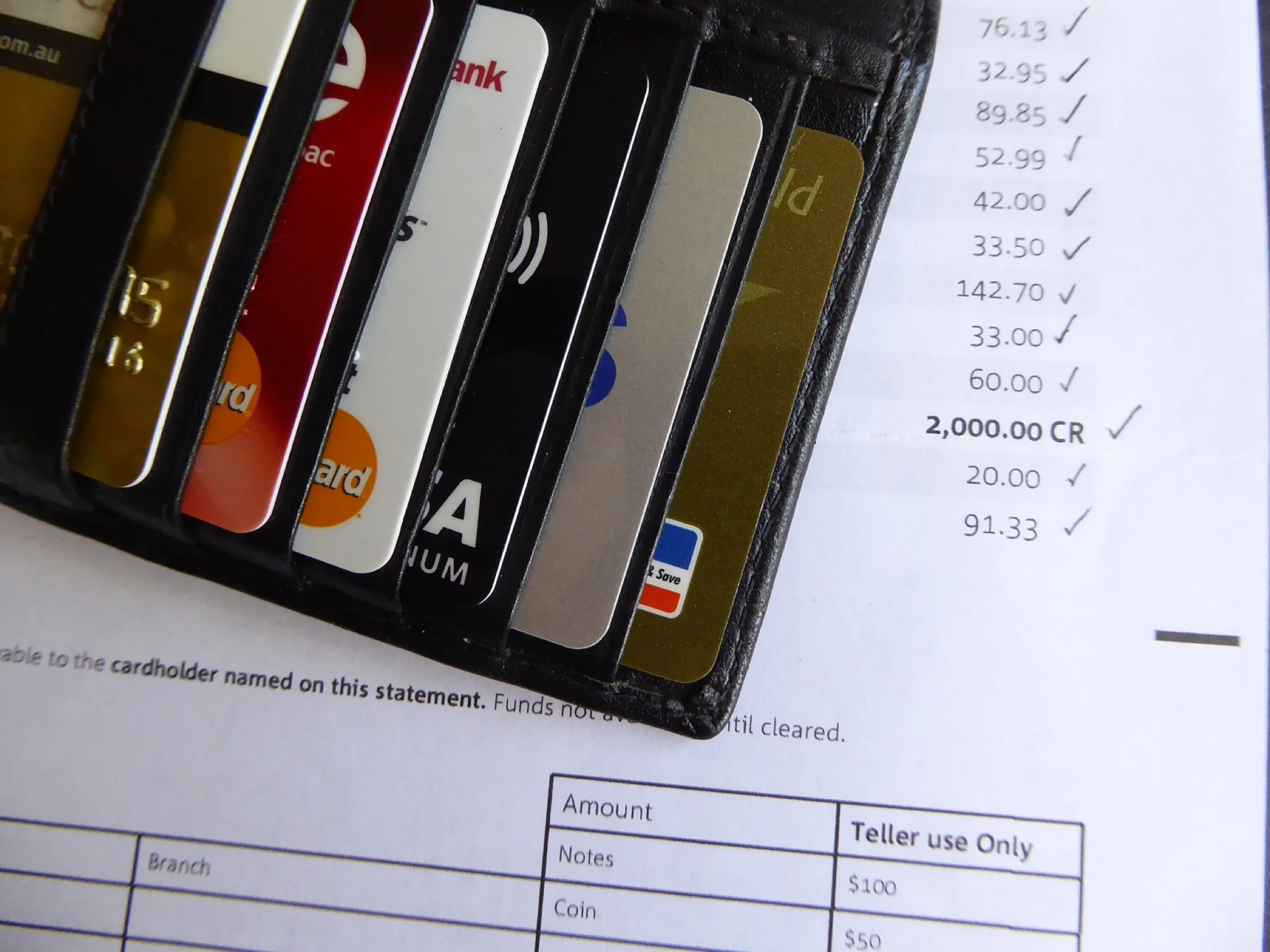

HOW TO: Splitting payments and deposits

It’s more and more common these days for your customer’s to pay a deposit, or pay their bill off in instalments. Same goes for your suppliers and payment terms – a deposit to start production and the balance on delivery for example. This is all good and well, but how do you record this in Xero without creating a million invoices for each stage?!

Creating Bank Reconciliation Rules in Xero

Integration in the Spotlight // Invitbox V ReceiptBank

Report for YOUR business

Cash or Accrual Basis... but what does it all meeean, Basil?!

HOW TO: Splitting 2 Tax Code Transactions

Internet and Phone, Produce, Insurance... to name a few of the common purchases that have multiple tax codes.

Here is an example, my phone bill is $180 (including $2.04 GST).....

Too much like hard work? We love this stuff.. don't waste your precious time crunching numbers when you could be chatting to customers, innovating or making sales!!!?

3 Common GST Mistakes

MARCH into this B.A.S with your game face on....!

"I would rather face root canal surgery with no anaesthetic than do bank reconciliations" - Devan Sabaratnam

Does that sound like you? Well it's that time again.. the end of a quarter.. but it doesn't have to be as bad as all that! Why not look at it as a clean slate, a time to reflect and check in with your business? BAS time can actually be used to your advantage!